Last Updated on September 11, 2023 by Patrick Jones Published: September 4, 2023

The Walmart W2 form is a tax document that Walmart employees receive annually.

It contains important information that is required for filing federal and state income taxes in the United States.

The W2 form shows an employee’s total earnings and tax withholdings.

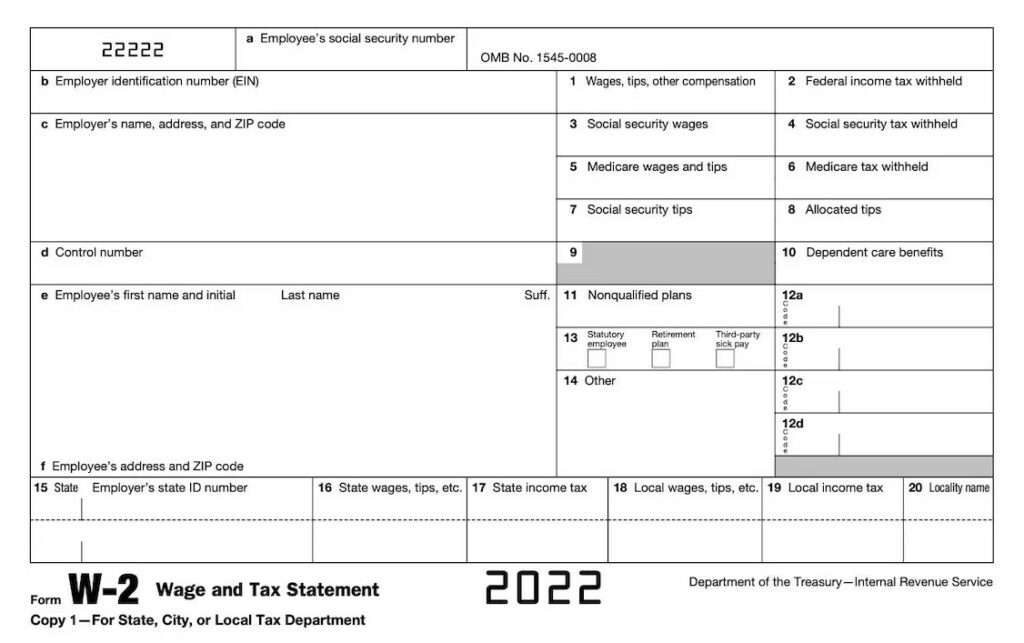

Walmart’s W2 form is divided into multiple boxes, each containing specific financial details.

Must-Read Walmart Insider Posts

- Onewalmart Login

- What is Walmart W2?

- Walmart Paramount+

- Use Coupons at Walmart

- Walmart GTA Portal

- Walmart Leave of Absence

- Employee Handbook

- W2 Former Employee

- Get Walmart W2

- W2 Form Benefits

Example of Walmart W2

For example, it will show your gross income, Social Security wages, Medicare wages, and various tax withholdings.

It may also include information on other deductions or contributions, such as retirement savings or health care.

Employers, including Walmart, are required by law to provide W2 forms to their employees by a certain date each year, usually by the end of January.

This form is essential for completing your tax return, as it provides the data you need to fill in various lines on your tax forms.

The W2 form is not just a Walmart-specific document; it is a standard form used by all employers in the United States.

However, each employer will have its own process for distributing these forms to their employees.

In summary, the Walmart W2 form is a crucial document for tax filing that provides a summary of an employee’s earnings and tax withholdings for the year.

Purpose of Walmart W2 Form

The Walmart W2 form serves multiple purposes beyond just being a requirement for tax filing:

Record-Keeping

It serves as an official record of your employment income and tax contributions for the year.

This can be useful for personal financial planning or if you need to provide proof of income for loan applications, housing rentals, or other financial transactions.

Accuracy in Tax Filing

The W2 form helps ensure that you file your taxes accurately.

Mistakes in tax filing can lead to penalties or delays in receiving a tax refund, so having a precise record is crucial.

Determining Refunds or Amounts Owed

The information on the W2 form can help you determine whether you will receive a tax refund or owe additional taxes.

If too much tax was withheld from your paychecks, you might be eligible for a refund. Conversely, if not enough tax was withheld, you may owe money.

State Taxes

If you live in a state that has an income tax, your W2 will also include information on state tax withholdings, which is essential for filing your state tax return.

Additional Benefits and Deductions

The form may also contain information about other benefits like contributions to a retirement plan, or deductions like union dues, which can affect your tax situation.

Legal Requirement

Employers are legally obligated to provide a W2 form to each employee and to file a copy with the Internal Revenue Service (IRS).

Failure to do so can result in penalties for the employer.

Multiple Jobs

If you have more than one job, you will receive a W2 form from each employer.

It’s essential to include information from all W2 forms when filing your taxes to ensure completeness and accuracy.

Future Reference

It’s a good idea to keep copies of your W2 forms for your records.

The IRS recommends keeping tax-related documents for at least three years in case of an audit.

Walmart W2 Contact Info

For more information related to the Walmart W2 Form, get in touch with the W2 Department today.

- Walmart W2 Number: 479-273-4323